If you live in Bernalillo County, New Mexico, you’ll soon receive something important in your mail. Starting May 1, the County Assessor’s Office is sending out the 2025 Notice of Value to every property owner. This notice gives details about your property, including its address, assessed value, and estimated tax. It’s important for all property owners to read this document carefully.

What is the Notice of Value?

The Notice of Value is a legal document that tells you how much your property is worth for tax purposes. This is not a bill, but it does help decide how much tax you’ll need to pay. The notice includes your name, your property’s address, and its current assessed value. It’s part of a program called “Know Your Value,” which aims to help people understand how their property is being valued.

Why You Should Check It

Mistakes can happen, and this is your chance to spot them. You should double-check the information on the notice. Make sure your name, address, and the property value are correct. If something is wrong, you should contact the Bernalillo County Assessor’s Office right away so they can fix it.

How to Dispute Your Property Value

If you don’t agree with the value listed on your notice, you have the legal right to file a protest or appeal. But you have to act fast. You only have 30 days from the date it was mailed to file your protest. Since the mail date is May 1, your deadline is June 2. After that, you lose the chance to contest the value until the next year.

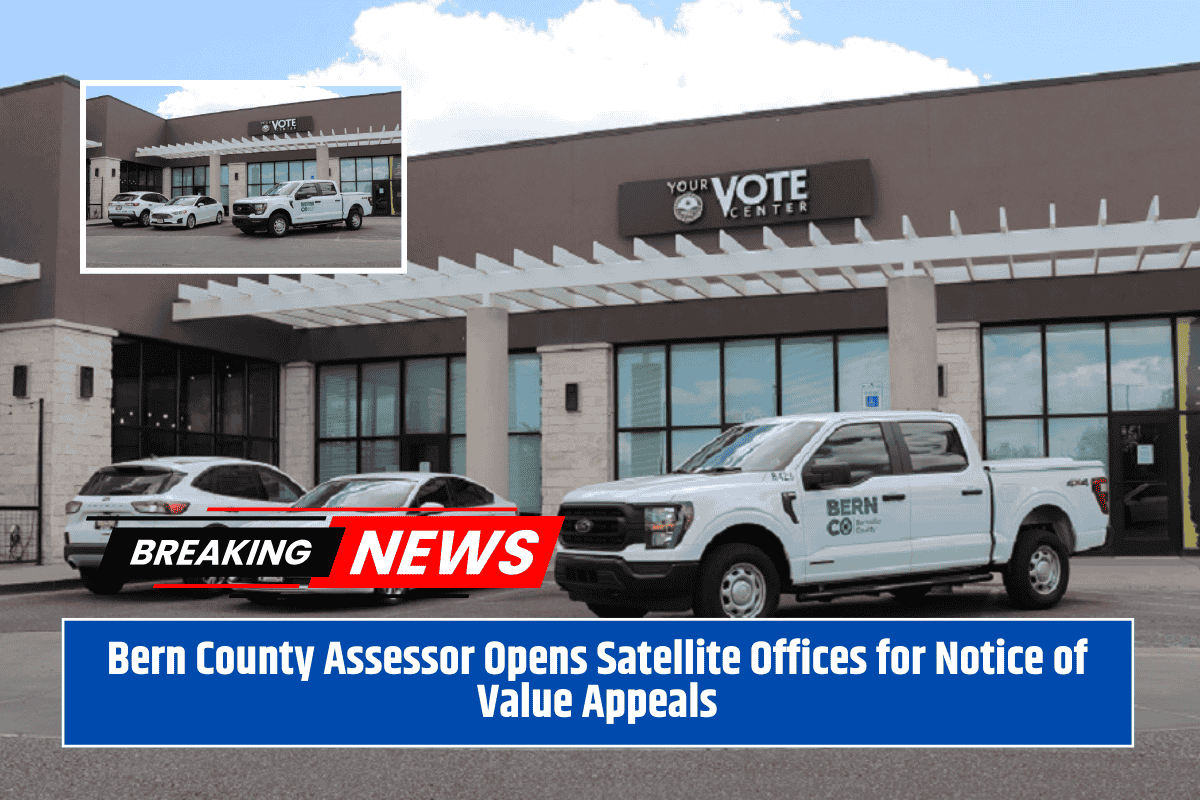

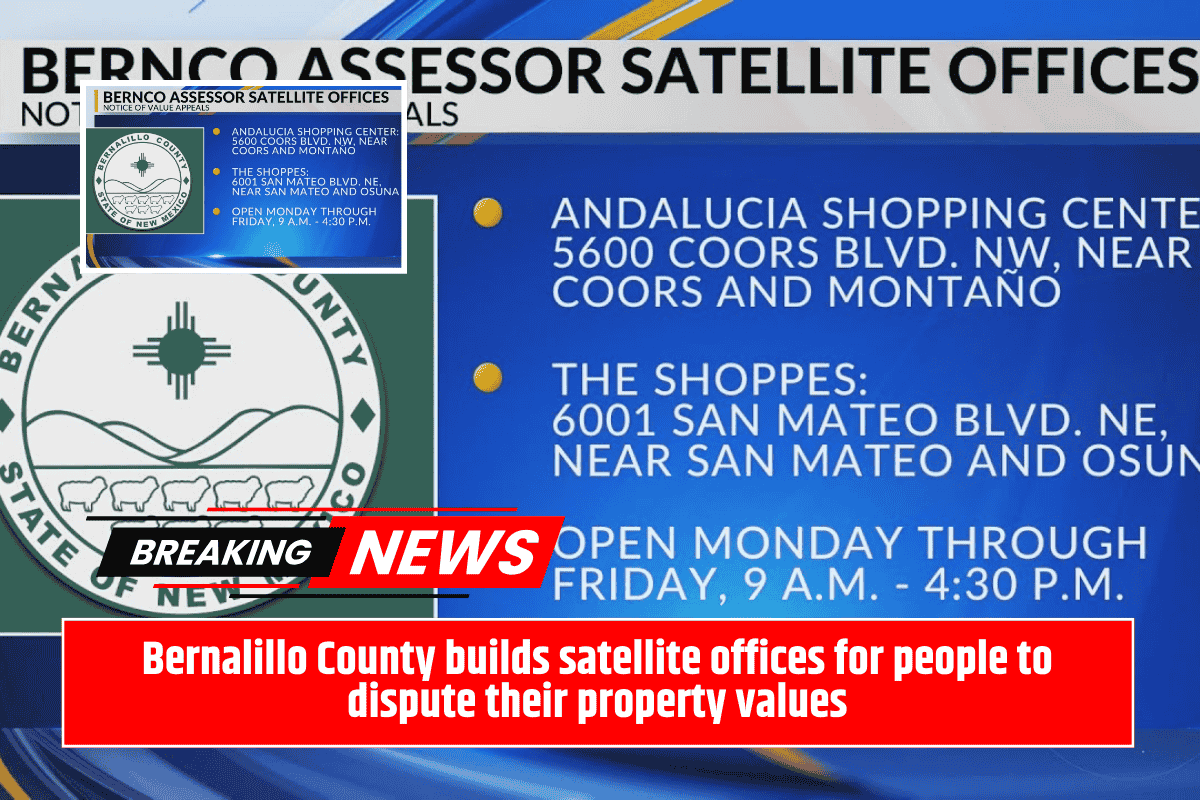

Where to Get Help

If you need help understanding your notice or want to file a protest in person, you can visit a Bernalillo County assistance center. Help is available Monday to Friday from 9:00 a.m. to 4:30 p.m., but keep in mind they’re closed from noon to 1:00 p.m. for lunch.

Two locations where you can get assistance: Andalucia Shopping Center – 5600 Coors Blvd. NW (near Coors & Montaño)

The Shoppes – 6001 San Mateo Blvd. NE (near San Mateo & Osuna)

You can also go to the main protest site at the Assessor’s Office in Alvarado Square, located at 415 Silver Ave. SW.

Other Ways to Get Help

If you prefer not to go in person, there are two easy ways to get your questions answered. You can visit the Assessor’s website at BernCo.gov/Assessor and use their chatbot, or you can call their customer service line at 505-222-3700.

Receiving a Notice of Value isn’t something to ignore. It affects how much you’ll pay in property taxes, so it’s important to make sure the information is accurate. If something looks wrong or you just have questions, don’t wait. Whether online, by phone, or in person, help is available—but only for a limited time. Make sure you check your notice and act before June 2 if you need to protest your property’s value.